Coming Soon: Banking Crisis of Historic Proportions

With everyone (well, almost everyone - I am one of the lonely skeptics) convinced that we have stepped back from the "edge of the abyss", the title of this article may be viewed as laughable. When you connect the dots, as I will in this article, you will at least stop laughing, and, maybe, realize that we still have a big problem.

We have a confluence of five factors that have the potential to create damage to banking not seen in 80 years, and that includes the Great Depression. We'll hit these factors one at a time.

First Factor: Banks Are Not Doing Enough Business

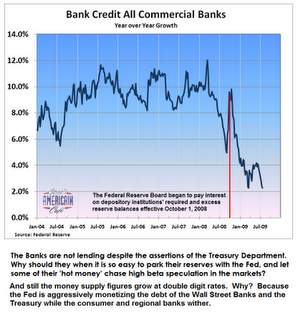

Commercial bank credit growth has dropped to 2%, according to Jesse's Cafe Americain (here). The recent history of credit growth is shown in the following graph.

Now, it is a good thing that banks are conserving capital, since they need to increase capital to offset bad loans.

But, if asset valuations deteriorate (and that is quite possible), the banks need to increase earnings to "earn their way" out of their problem. Interest paid by the Fed for reserves on deposit there (by the commercial banks) are not producing nearly the same level of income as new credit issued commercially under our fractional reserve banking system with much higher interest .

If credit issuance does not increase year over year, banks can not improve their financial condition unless the quality of their existing loan portfolio improves.

As discussed in the third factor, below, just the opposite is anticipated for loan portfolios.

So the first factor in this perfect storm is that the banks are not doing enough business.

Second Factor: Banks Are Failing at a Rate Not Anticipated Two Months Ago

In his article, Jesse mentions reports by Bloomberg that 150 banks are in trouble. Some of these will be larger than many of the 77 (mostly community) banks that have gone under FDIC receivership so far in 2009.

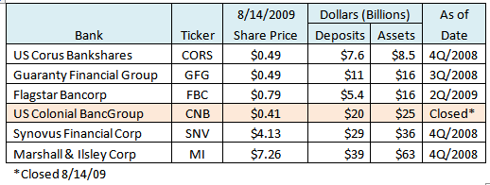

Banks mentioned being in trouble by Bloomberg (here) include Wisconsin’s Marshall & Ilsley Corp. (MI), Georgia’s Synovus Financial Corp. (SNV), Michigan’s Flagstar Bancorp (FBC), Chicago-based Corus Bankshares Inc. (CORS), Austin-based Guaranty Financial Group Inc (GFG), and Colonial BancGroup Inc. (CNB) in Montgomery, Alabama.

These six banks became five at the close of business Friday, Aug. 14, as Colonial BancGroup was taken over by the State of Alabama and the FDIC. This was the largest bank failure since IndyMac Bank went under in the summer of 2008.

The following table shows some data regarding the six banks singled out by name in the Bloomberg article.

On July 5, Bill Cassill wrote (here) that he projected 125 bank failures for 2009 and 230 in 2010.

However, as of that date, Bill projected 82 closings by 9/30 and we have already reached 77 on 8/14. We still have half the quarter to go. With the 150 additional banks estimated by the Bloomberg article, and the 77 already closed thus far this year, we could be closer to 230 closings in 2009 than the 125 estimated just six weeks ago. Bill is not alone. I recall hearing other estimates of bank failures for 2009 of the order of 100 for the entire year.

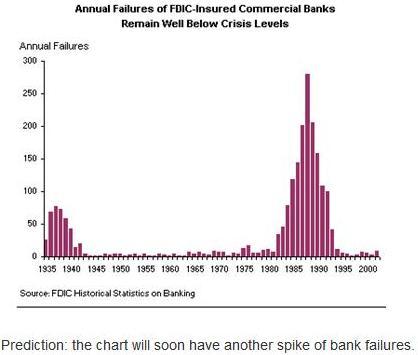

The following graph (and the prediction below it) was provided on July 12 (here) by Colin Peterson.

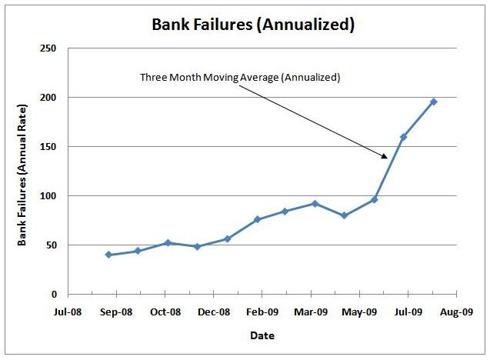

How is Colin's prediction doing? The following graph shows how bank failure rates have been trending.

Give Colin the handicapper award here. Not only have bank failure rates spiked, the current annualized rate would be in a virtual three-way tie for second highest in history if maintained for another nine months.

link.....

Post a Comment