Top banks cut small business lending by $8 billion

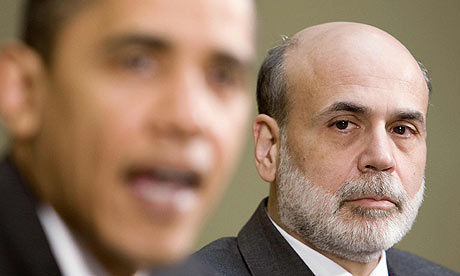

President Obama is trying -- again -- to help small business get the cash they desperately need.

The President will visit a small business in Maryland on Wednesday to present a series of initiatives aimed at increasing bank lending to small businesses, according to a White House official.

The programs the President will unveil include an increase in the maximum amount businesses can borrow through the Small Business Administration's primary loan program, which currently stands at $2 million. In addition, the Treasury Department will expand access for smaller banks to the Troubled Asset Relief Program (TARP), a move aimed at spurring more local lending by community banks.

The TARP program was set up to recapitalize banks so that they would bolster their lending to consumers and small businesses. In March, as the administration and the SBA took steps to stimulate small business lending, Treasury Secretary Tim Geithner ordered the top TARP recipients to begin sending the Treasury monthly reports on their small business lending activity.

"We need every bank in the country to do everything in their power to provide the credit that small businesses need to operate, expand and add jobs," Geithner said as he announced the new requirements. "Given the role many banks played in causing this crisis, you bear a special responsibility for helping America get out of it." link.....

![[qa]](http://s.wsj.net/public/resources/images/BA-AQ362A_QA_p_NS_20090821132817.jpg)