TARP cop: Get tough on banks

WASHINGTON (CNNMoney.com) -- The top cop tracking the $700 billion bailout program said Monday that he's concerned federal officials are ignoring his proposals for preventing tax dollars from being wasted or pilfered.

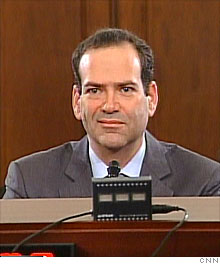

Neil Barofsky, the special inspector general overseeing the Troubled Asset Relief Program, released a 260-page report detailing a long list of concerns about government efforts to prop up hundreds of banks, Wall Street firms and auto companies.

The report criticizes the Treasury Department the most for its unwillingness to adopt some of his recommendations.

Barofsky cites two examples: He wants Treasury to force bailout recipients to keep track of how exactly they are spending TARP funds. He also wants officials to erect a "firewall" to prevent private investment managers -- the kind hired to manage and invest taxpayer dollars -- from taking advantage of insider knowledge.

"Although Treasury has taken some steps towards improving transparency in TARP programs, it has repeatedly failed to adopt recommendations that SIGTARP believes are essential to providing basic transparency and fulfill Treasury's stated commitment to implement TARP 'with the highest degree of accountability and transparency possible,' " the report stated.

Barofsky is set to testify about the report Tuesday morning before a House Oversight panel.

The special IG's office, which was established as part of the TARP program enacted last fall, has also launched 35 criminal and civil investigations into a range of allegations from accounting and securities fraud to insider trading and public corruption, the report said.

Some of Barofsky's investigations have already led to criminal and civil charges against those accused of fraudulently benefiting from the government's bailout program.

Risk in the trillions?

Some lawmakers are already squealing about one figure in Barofsky's report, which assigns an eye-popping value of $23.7 trillion as the sum total of dozens of federal programs supporting companies, industries and consumers affected by the economic meltdown.

"Any assessment of the effectiveness or the cost of TARP should be made in the context of these broader efforts," Barofsky is expected to say to the House panel, according to testimony acquired by CNNMoney.com.

The $23.7 trillion number is a "staggering figure," said Rep. Darrell Issa, R-Calif., the ranking minority member of the House Oversight panel.

Yet, the aggregate figure contains programs that the government is no longer on the hook for. For example, it includes $12.9 billion bridge loan to JPMorgan Chase to buy failed investment bank Bear Stearns in March 2008 -- that loan was repaid in full with taxpayers making $4 million in interest.

The aggregate figure also includes bank debt backed by the Federal Deposit Insurance Corp. Taxpayers are on the hook if the banks can't make good on the debt, but so far taxpayers haven't lost a dime and have in fact made billions in fees paid to the program, said industry analyst Jaret Seiberg, who generally supports transparency and disclosure of risk.

"You can start raising questions about lots of different components, but that's throwing lighter fluid on an already politically-charged fight to produce nothing of substance," said Seiberg of Concept Capital's Washington Research Group.

A Treasury official on Monday called the $23.7 trillion figure "inflated," saying it ignores fees and interest that regulators collect to compensate taxpayers for taking on risk. The official added that Barofsky's estimate doesn't take into account assets the federal government now owns that "offset the risk" in these programs.

"While quantity and quality of the assets backing all of these programs vary, ignoring that side of these programs misrepresents 'potential exposure' associated with them," the official said. link....

Post a Comment